Our Mission

We engage and encourage people through digital, print, prayer and broadcast ministries that are all about Jesus.

Our Vision

We engage and encourage people to behold and follow Jesus Christ.

Our Hosts

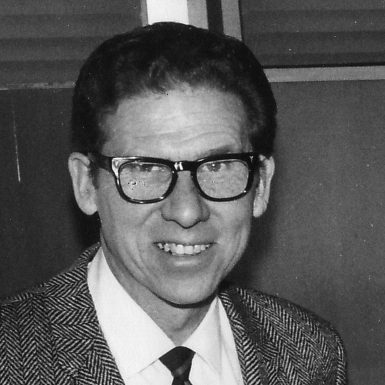

Paul Myers

1934 – 1971

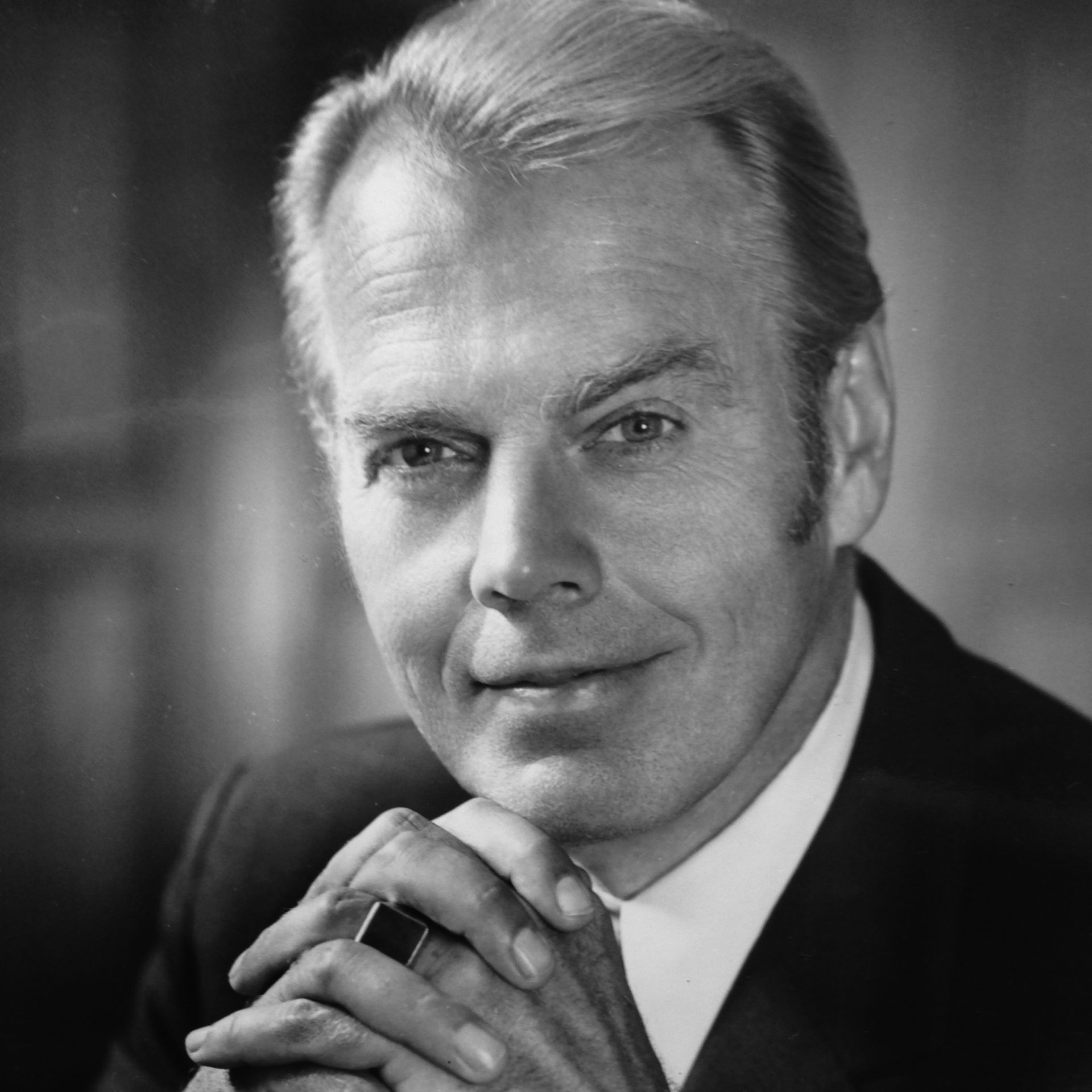

Paul Evans

1971 – 1989

Ray Ortlund

1989 – 2000

Charles Morris

2000 – 2024

David Wollen

2024 – Today

Our Story

Founded in 1934, Haven Ministries has always had a simple mission: to tell the world all about Jesus.

It started on an early foggy morning in 1934, when Paul Myers, a former Los Angeles radio personality and station manager of leading radio stations woke up near a wharf in San Diego. Hungover, he heard the sound of a ship’s bell ring out eight times at 4:00 a.m., signaling “all’s well.” It was a Sunday morning and Myers knew that all was not well with him. He got up and spent his last pennies on a small breakfast instead of more alcohol and went to church. He was turned away because of his appearance but went back to his cheap hotel room and started reading the Gideon’s Bible. That day he met Jesus.

Only one month later, Myers was back on the radio, but this time, sharing his new-found faith. He founded a Christian radio program called, “Haven of Rest” that began each program with the words he heard the day of his salvation,

“Ahoy there shipmate … eight bells and all’s well.”

Today, the daily broadcast – called HAVEN Today – airs on more than 650 stations in North America and around the world with a daily listenership of over 500,000.

In addition, the printed ANCHOR Devotional encourages thousands through print to live their lives in real rest and peace, in Christ. Subscribe Today

In January, 2015, Anchor Today, launched as a one minute audio version of the daily devotional. Voiced by David Wollen, Anchor Today is heard on about 450 stations across North America.

In February of 2018, Haven Ministries started our first ever Spanish-speaking radio program for believers and non-believers alike. El Faro de Redención, or “Redemption Lighthouse” is voiced by Danny Rojas. It began on a 500,000 watt station on the Caribbean island of Bonaire and covers the entire nation of Cuba. El Faro now reaches into more than 30 countries around the world every day where Spanish is the primary language spoken and heard.

Our Ministry

Anchor Devotional

Christ-centered readings that connect people to God through His Word daily in a printed booklet.

All About Jesus Blog

Messages from David and special guests who share stories about the hope found in Jesus.

Spanish Broadcast

El Faro de Redención now reaches more than 30 countries around the world every day.

Monthly Partners

Would you be someone who agrees to pray regularly and give automatically each month?